Occupational Certificate: Financial Markets Practitioner (OC: FMP)

Qualification ID 117238 Occupational Certificate: Financial Markets Practitioner (NQF Level 7)

The SAIS has developed the Financial Markets Practitioner (FMP), an entry level qualification, for those wishing to move into this sector. The Occupational Certificate: Financial Markets Practitioner (OC:FMP) is aimed at providing learners with entry-level knowledge, practical skills and experience in key functions in the financial markets. The OC:FMP qualification consists of three components:

- • Knowledge;

- • Practical skills; and

- • Work experience.

The focus of the work experience is to provide the learner with the opportunity to acquire context, knowledge and exposure to the work environment. Financial Markets Practitioners provide services across various functions in the stockbroking and investment environments. They are involved in the take-on of clients, the assessment of clients’ investment needs, the development of suitable investment portfolios, trading and settlement of financial markets transactions, the management of corporate actions and the monitoring and re-balancing of portfolios.

Delivery of the Qualification

The Knowledge and Practical Skills components are delivered by Skills Development Providers (SDPs) who have been accredited by the QCTO for the OC: FMP. The accredited SDPs are listed below and a can also be found on the QCTO website.

Content of the Qualification

Knowledge modules

The Knowledge modules will provide the learner with the correct theoretical underpinnings and understanding of concepts in the financial markets.

| Module | NQF Level | Credits |

|---|---|---|

|

Introduction to Financial Markets |

6 | 5 |

| Asset Class - Equities Securities | 7 | 12 |

| Asset Class - Interest Bearing Securities | 7 | 8 |

| Asset Class - Derivative Securities | 7 | 5 |

| Asset Class - Alternative Securities | 7 | 5 |

| Basic Economics | 7 | 10 |

| Asset Class - Foreign Exchange | 7 | 3 |

| The Regulation of the Financial Markets | 7 | 12 |

| Client Service and Investment Advice | 7 | 12 |

| Trading | 7 | 10 |

| Settlement of financial markets transactions | 7 | 10 |

| Corporate Actions | 7 | 7 |

| Investment Vehicles | 6 | 5 |

Practical Modules

The practical modules will allow the learner to put the theory into practice. This will most often take place in a simulated environment.

| Module | NQF Level | Credits |

|---|---|---|

| Analyse, evaluate and review equity securities for investment purposes | 7 | 8 |

| Analyse, evaluate and review interest bearing securities for investment purposes | 7 | 3 |

| Apply economic knowledge to the investment environment | 7 | 3 |

| Examine the regulatory and legislative landscape applicable to financial markets | 7 | 3 |

| Prepare investment advice in a simulated environment | 7 | 8 |

| Use a simulated trading system to apply trading knowledge | 7 | 4 |

| Explain the settlement process to a controlled and non-controlled client | 7 | 3 |

| Interpret corporate action announcements and process the resulting transactions | 7 | 3 |

| Apply the unitisation concepts | 7 | 5 |

Work experience

Learners need to acquire actual experience in the workplace, in order to complete their eligibility criteria for the EISA. The work experience must be gained at an accredited workplace. A fee is charged for the workplace accreditation The work experience will provide the learner with the real, tangible implementation of the theory and the practical experience. It has the added benefit of providing the learner with work experience in the financial markets. A minimum of 6 months’ work experience is required. Learners completing the OC: FMP are required to attain experience in 9 areas (7 compulsory and 2 elective), as follows:

| Work Experience Area | Compulsory | Elective |

|---|---|---|

| Prepare and present research reports | ü | |

| Do financial markets presentations | ü | |

| Evaluate the organisation's control environment | ü | |

| Evaluate a stock and prevailing market conditions for trading purposes | ü | |

| Perform settlement activities | ü | |

| Complete clients’ take-on processes | ü | |

| Perform a client needs analysis | ü | |

| Re-balance client portfolios | ü | |

| Prepare client feedback reports | ü | |

| Perform administration of corporate actions | ü |

Entry Requirements

- NQF Level 6 qualification in finance or a related field of study: or

- NQF Level 6 qualification with three years’ relevant assessed work experience in the financial markets; OR

- Five years’ relevant work experience in the financial markets.

For the candidates that require three years’ relevant assessed work experience in the financial markets, this can be assessed as follows:

Performance Appraisal Portfolio of Evidence

A Portfolio of Evidence (PoE) comprising a minimum of three (3) years’ worth of performance appraisals is required to be submitted. The work that has been assessed through the performance appraisal should be linked to the Work Experience Areas of the OC: FMP. All the compulsory work experience areas need to be evidenced and two of the elective areas.

The employer will need to submit to the Skills Provider, the PoE and a confirmation that in their (employer’s) opinion, the experience is valid and a true reflection of the student’s abilities. This will allow the learner to gain entry to the FMP.

If the employer is an Accredited Workplace for the OC: FMP, based on the experience, the PoE can also be used as confirmation that Recognition of Prior Learning (RPL) has taken place. This will exempt the learner from having to gain the six (6) months’ work experience required for the OC: FMP.”

External Integrated Summative Assessment (EISA)

Only once all three components i.e. Knowledge, Practical Skills and Work Experience, have been completed, can learners enrol to complete the EISA. A successfully completed EISA is required in order to obtain the qualification.

The EISA consists of two (2) examination papers. For a successful EISA, both examinations need to be completed with a pass mark of 50% obtained for each examination. Should a learner obtain a pass for only one (1) of the examinations, that pass will be held in credit until the following examination session. Should the learner elect not to write in the following examination session or fail the examination again, the credit will fall away and both examinations will have to be re-attempted.

Once the OC: FMP has been obtained successful candidates are eligible to apply for the designation CFMP(SA) - Certified Financial Markets Professional (South Africa), awarded by the SAIS. Exemplars of the EISA can be viewed for an indication of how students will be assessed.

Semester 1

Below are important dates for the EISA Semester 1 exams:

| EISA Activity | Date |

|---|---|

| Exam Prep Session for Paper 1 (Virtual session with subject expert) | 22 April 2025 |

| Exam Prep Session for Paper 2 (Virtual session with subject expert) | 23 April 2025 |

| FMP: EISA - Paper 1 Revision | 14 May 2025 |

| EISA Exam - Paper 1 | 19 May 2025 |

| EISA Exam - Paper 2 | 20 May 2025 |

Semester 2

| EISA Activity | Date |

|---|---|

| Exam Prep Session for Paper 1 (Virtual session with subject expert) | 28 August 2025 |

| Exam Prep Session for Paper 2 (Virtual session with subject expert) | 04 September 2025 |

| EISA - Exam Paper 1 | 06 October 2025 |

| EISA - Exam Paper 2 | 07 October 2025 |

Recognition of Prior Learning (RPL)

The Knowledge, Practical Skills and Work Experience components of the qualification can be achieved through RPL. The Skills Development Providers (SDPs) that have been accredited to deliver the qualification will assess RPL for the Knowledge and Practical Skills components. The accredited workplaces will be able to assess RPL for the work experience components.

Learnership

A learnership has been registered against the OC: FMP qualification. The learnership is registered through the Financial and Accounting Sector Education and Training Authority (FASSET). The SAIS does not place learners into employment for the purposes of completing the OC: FMP qualification or learnership.

In order to place a learner onto a learnership a work-based learning programme agreement must be concluded. There are two categories of learner, namely previously employed and previously unemployed. As defined by section 18 (1) of the Skills Development Act (SDA), No.97 of 1998 (as amended), previously employed typically refers to current employees of the organisation. Section 18 (2) of the SDA defines previously unemployed learners as those not previously employed by the organisation.

In order to place a learner onto a learnership, the employer must sign an employment agreement with the learner, if they are not currently employed by the organisation, as well as a work-based learning programme agreement. The employment of current employees is not affected by the signing of a work-based learning programme agreement. Where previously unemployed learners are concerned, the employment agreement must be for the duration of the learnership, at minimum. On completion of the learnership, employers are under no obligation to employ the previously unemployed learner.

Learners and employers must remember that if learners are placed on the learnership that is registered against the OC: FMP, they are deemed to be normal employees. As such they must adhere to all of the required workplace policies and legalities. Once employed, learners have all same rights as any employee. The employer (workplace provider) is only obligated to employ the learner for the duration of the learnership. It must be borne in mind that employers are not obligated to put learners on a learnership. The OC: FMP can be completed outside of the learnership vehicle.

Please Note: As per the rules of the Quality Council for Trades and Occupations (QCTO), the Assessment Quality Partner (AQP) which is the SAIS, cannot accredit the Skills Development Providers (SDP). The accreditation of Skills Development Providers is done solely by the QCTO. The SAIS can therefore not endorse any of the providers.

| Skills Development Provider (SDP) | Contact Details | Accreditation Number | Accreditation Period |

|---|---|---|---|

| ASISA Academy NPC |

t: +27 21 673 1626 |

01-QCTO/SDP100621-2050 | 9 June 2021 - 8 June 2026

|

|

Catalyst AI (Pty) Ltd |

e: csmith@apexu.co.za; byron@apexu.co.za t: +27 73 574 9438 |

07-QCTO/SDP280423122548 | 28 April 2023 - 27 April 2028 |

| Novia One Group (Pty) Ltd |

t: +27 11 783 9390 |

07-QCTOSDP01191120-1861 | 27 October 2021 - 26 October 2026 |

| The Sherq Centre of Excellence (Pty) Ltd |

t: 087 807 8564 |

07-QCTO/SDP030123063535 | 1 March 2023 - 1 February 2028 |

| Felix Risk Training Consultants CC |

t: 031 207 3245 |

05-QCTO/SDP140924172541 | 13 September 2024 - 12 September 2029 |

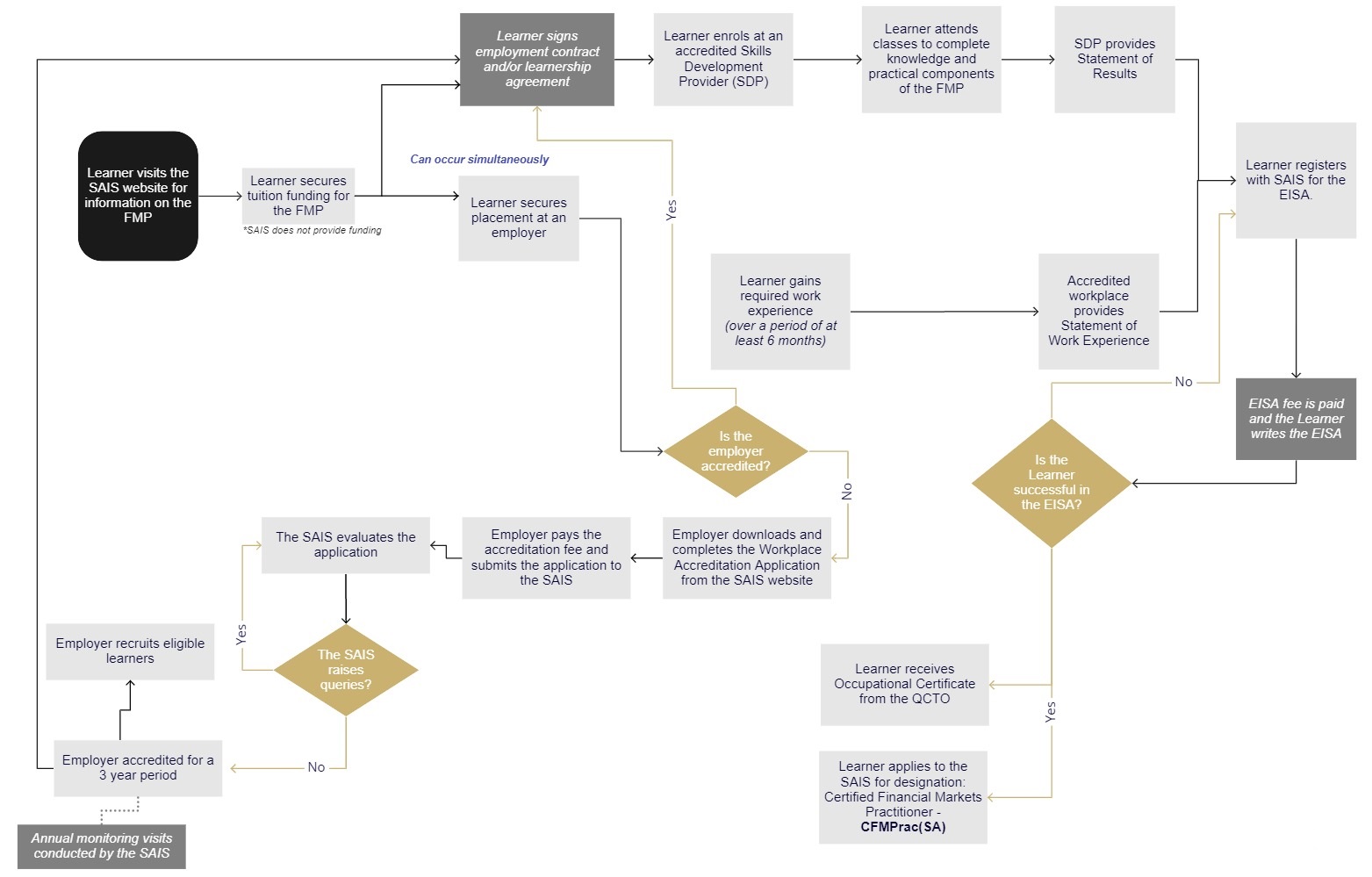

Financial Markets Practitioner Process